Finance and Tax Platforms of the 2025 Canadian Federal Election

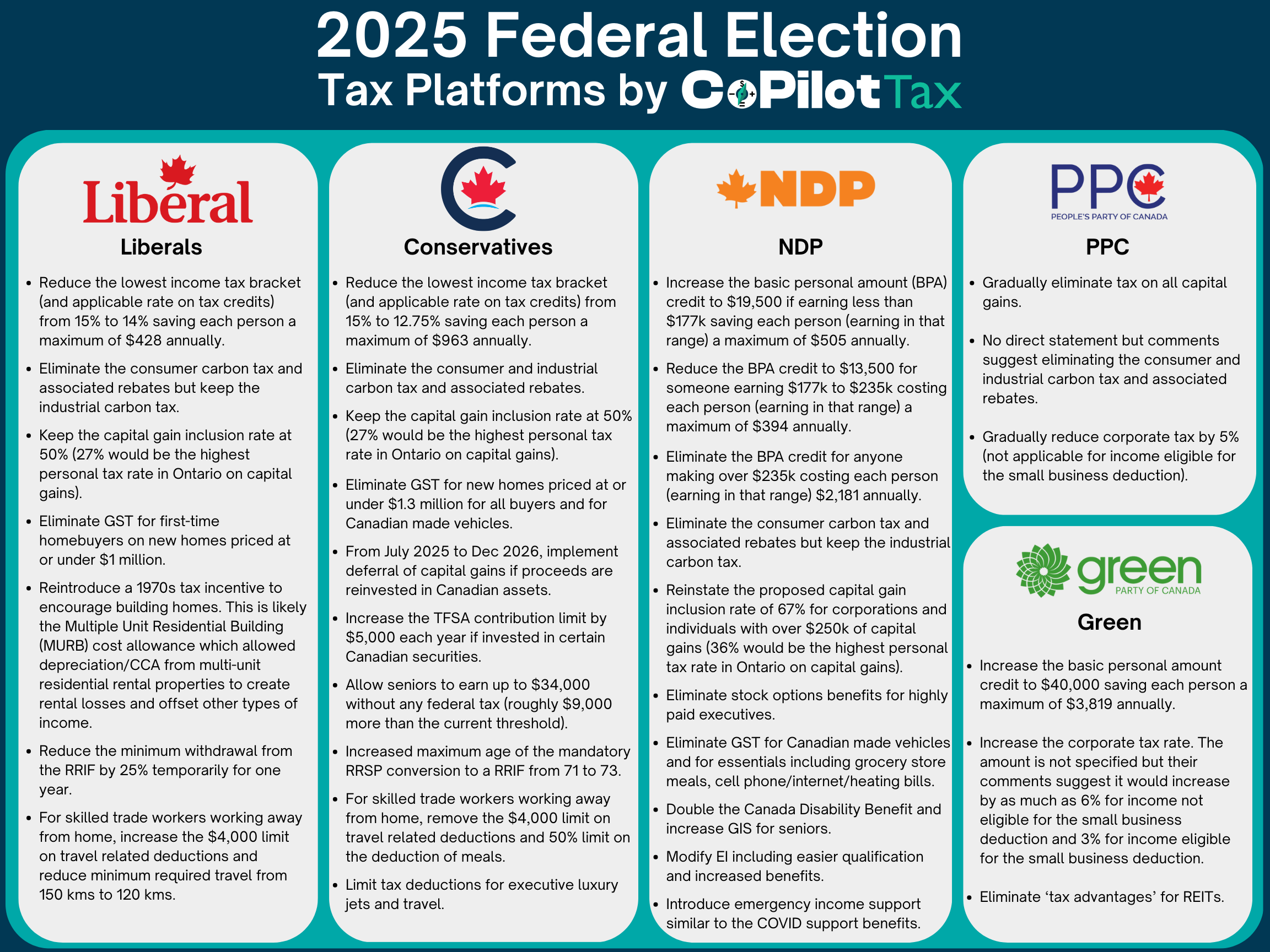

The above is an image which summarizes the tax platforms of five different federal parties in Canada.

Mark Carney’s Liberals

The following is a summary of the Liberal Party’s tax platform:

- – Reduce the lowest income tax bracket (and applicable rate on tax credits) from 15% to 14% saving each person a maximum of $428 annually.

- – Eliminate the consumer carbon tax and associated rebates but keep the industrial carbon tax.

- – Keep the capital gain inclusion rate at 50% (27% would be the highest personal tax rate in Ontario on capital gains).

- – Eliminate GST for first-time homebuyers on new homes priced at or under $1 million.

- – Reintroduce a 1970s tax incentive to encourage building homes. This is likely the Multiple Unit Residential Building (MURB) cost allowance which allowed depreciation/CCA from multi-unit residential rental properties to create rental losses and offset other types of income.

- – Reduce the minimum withdrawal from the RRIF by 25% temporarily for one year.

- – For skilled trade workers working away from home, increase the $4,000 limit on travel related deductions and reduce minimum required travel from 150 kms to 120 kms.

Pierre Poilievre’s Conservatives

The following is a summary of the Conservative Party’s tax platform:

- – Reduce the lowest income tax bracket (and applicable rate on tax credits) from 15% to 12.75% saving each person a maximum of $963 annually.

- – Eliminate the consumer and industrial carbon tax and associated rebates.

- – Keep the capital gain inclusion rate at 50% (27% would be the highest personal tax rate in Ontario on capital gains).

- – Eliminate GST for new homes priced at or under $1.3 million for all buyers and for Canadian made vehicles.

- – From July 2025 to Dec 2026, implement deferral of capital gains if proceeds are reinvested in Canadian assets.

- – Increase the TFSA contribution limit by $5,000 each year if invested in certain Canadian securities.

- – Allow seniors to earn up to $34,000 without any federal tax (roughly $9,000 more than the current threshold).

- – Increased maximum age of the mandatory RRSP conversion to a RRIF from 71 to 73.

- – For skilled trade workers working away from home, remove the $4,000 limit on travel related deductions and 50% limit on the deduction of meals.

- – Limit tax deductions for executive luxury jets and travel.

Jagmeet Singh’s NDP

The following is a summary of NDP’s tax platform:

- – Increase the basic personal amount (BPA) credit to $19,500 if earning less than $177k saving each person (earning in that range) a maximum of $505 annually.

- – Reduce the BPA credit to $13,500 for someone earning $177k to $235k costing each person (earning in that range) a maximum of $394 annually.

- – Eliminate the BPA credit for anyone making over $235k costing each person (earning in that range) $2,181 annually.

- – Eliminate the consumer carbon tax and associated rebates but keep the industrial carbon tax.

- – Reinstate the proposed capital gain inclusion rate of 67% for corporations and individuals with over $250k of capital gains (36% would be the highest personal tax rate in Ontario on capital gains).

- – Eliminate stock options benefits for highly paid executives.

- – Eliminate GST for Canadian made vehicles and for essentials including grocery store meals, cell phone/internet/heating bills.

- – Double the Canada Disability Benefit and increase GIS for seniors.

- – Modify EI including easier qualification and increased benefits.

- – Introduce emergency income support similar to the COVID support benefits.

Maxime Bernier’s PPC

The following is a summary of PPC’s tax platform:

- – Gradually eliminate tax on all capital gains.

- – No direct statement but comments suggest eliminating the consumer and industrial carbon tax and associated rebates.

- – Gradually reduce corporate tax by 5% (not applicable for income eligible for the small business deduction).

Jonathan Pedneault & Elizabeth May’s Green Party

The following is a summary of the Green Party’s tax platform:

- – Increase the basic personal amount credit to $40,000 saving each person a maximum of $3,819 annually.

- – Increase the corporate tax rate. The amount is not specified but their comments suggest it would increase by as much as 6% for income not eligible for the small business deduction and 3% for income eligible for the small business deduction.

- – Eliminate ‘tax advantages’ for REITs.

Contact Us

If you’re interested in finding out how any of these policies may affect you, contact us today.