Ultimate Salary vs Dividends Guide: 4 Steps to Decide How to Pay Yourself from Your Corporation

Choosing the right method to pay yourself from your corporation—salary or dividends—is a crucial decision that impacts your taxes, cash flow, and long-term financial planning. There is a lot of bad information about whether you should pay yourself salary or dividends. Many articles don’t even provide a framework. This article uses four steps to guide you on how much salary or dividends to pay yourself from your corporation.

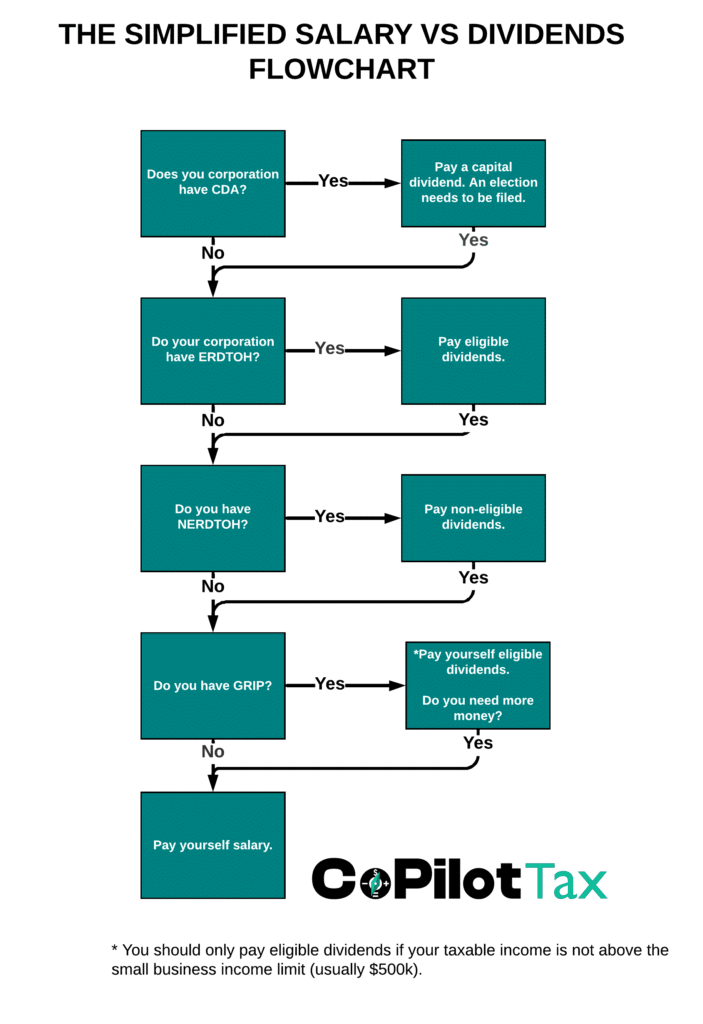

While it is only 4 steps, they are intensive four steps and very technical. There is also a simplified version that can be followed.

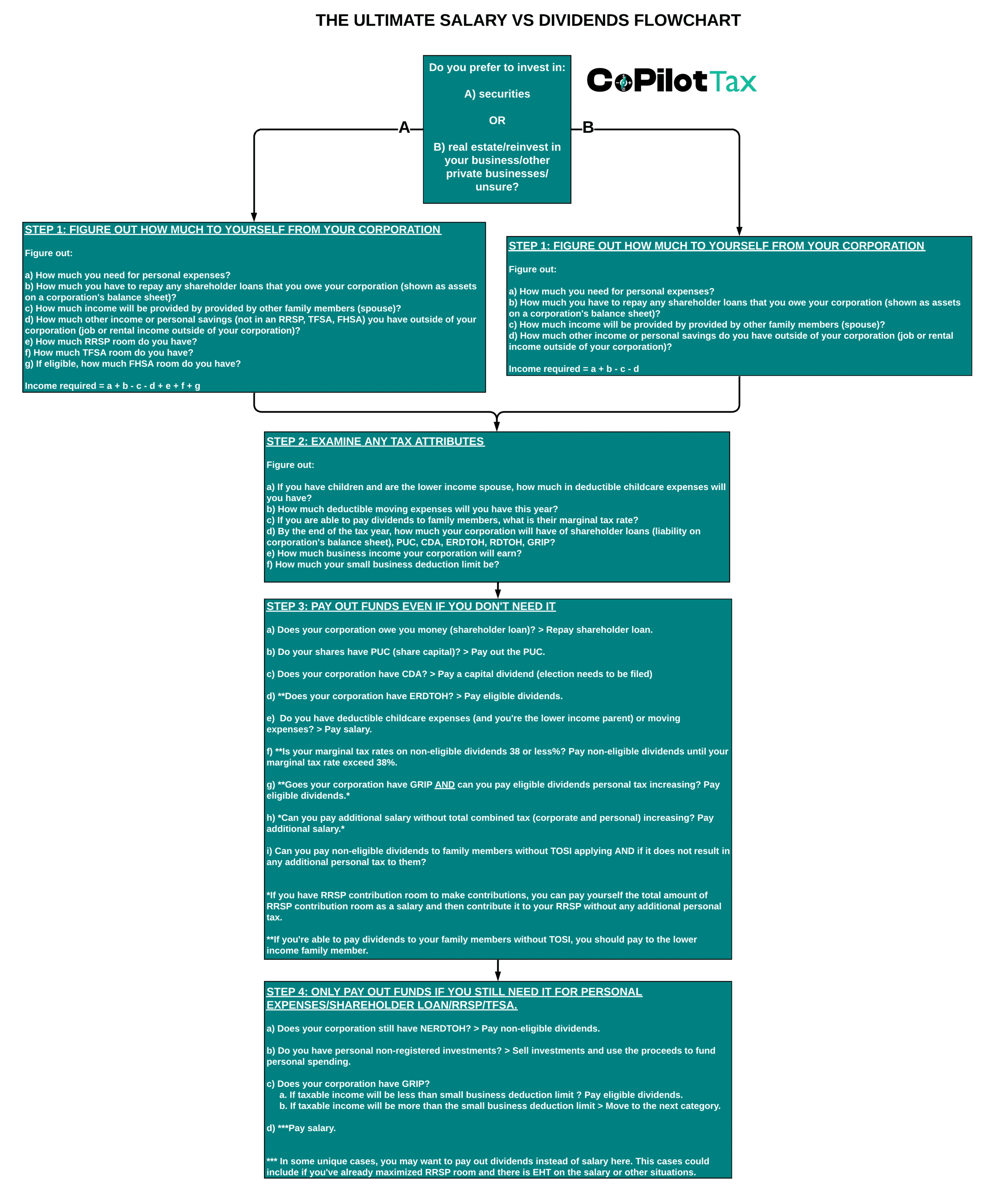

There are four steps to decide and whether to pay yourself salary, dividends, or a combination.

Step 1: Figure out how much to pay yourself from the corporation – The first step involves finding out how much you need to pay yourself from your corporation. This will depend on how much your personal expenses are, how much of your personal expenses will be covered by other sources of income or income from other family members, and how much of a shareholder loan you need to repay, your RRSP room, TFSA room, etc. If you already have this number, you can skip it.

Step 2: Examine your tax attributes – The optimal way to compensate yourself from your corporation depends on several factors. We need to gather all the relevant facts before we can analyze. There are various deductions, tax-free income that can be tapped into it. These various tax attributes that will determine the decision.

Step 3: Pay yourself even if you don’t need it – Based on certain corporate attributes and personal facts, we look at various ways you should pay yourself even if you don’t need the money. This is contrary to a lot of guidance that is out there which generally says you should pay yourself as little as possible because there are higher personal tax rates. Why would you pay yourself from the corporation if you don’t need the money? The reason is because it might be better for your long-term financial well-being. Because of your tax attributes, you could pay yourself without paying a lot of tax.

Step 4: Pay yourself only if you need it – After Step 3, it is possible that you still need more money. You may not even have received any money from your corporation from Step 3 if you don’t have any tax attributes. As such, you should go line by line in Step 4 until you get enough money to fund your personal expenses.

Details of each step are provided below.

Step 1: Determine how much to pay yourself from the corporation

The following actions will help you determine how much you should pay yourself from the corporation. If you already have an idea of how much you should pay yourself from your corporation, then you can move to Step 2.

a) Personal Expenses: Determine how much you need for personal expenses and any shareholder loan repayments. This is important because you cannot use corporate money to pay for personal expenses like rent/mortgage, groceries, etc. You have to pay yourself from your corporation to cover these expenses.

b) Shareholder loans: There are two types of shareholder loans. The first is where the corporation owes you money (shown as assets on the corporation’s financial statement). The second is where you borrowed money from your corporation (shown as assets on the corporation’s financial statements). If you have the second kind, that usually needs to be repaid within a year (in some cases longer). As such, that adds to the amount you need to pay yourself from your corporation.

c) Income from family members: If a family member earns a salary, their salary can cover some or even all of the personal expenses. This can help reduce how much you need to pay yourself from your corporation.

d) Income from sources other than your corporation: If you earn income from other sources outside of your corporation such as personally held real estate, investments, etc, this can help reduce how much you need to pay yourself from your corporation.

e) RRSP Contribution Room: This only applies for people who prefer to invest in securities. Check your available RRSP room to potentially reduce personal income tax with contributions. Salaries create RRSP contribution room, which allows you to save for retirement while deferring taxes. It’s also usually better to invest through your RRSP than it is from your corporation. So if you have $100k in your corporation and $100k of room in your RRSP, you can directly pay that to yourself and contribute it to your RRSP without any additional personal income tax.

f) TFSA Contribution Room: This only applies for people who prefer to invest in securities. Calculate how much room you have in your TFSA for tax-free savings. Investments can generally grow tax-free in a TFSA. As such, you may want to maximize it each year as it is usually better to invest in your TFSA than it is to invest in your corporation.

g) FHSA Contribution Room (if eligible): This only applies for people who prefer to invest in securities. If you’re eligible and it’s an appropriate time for you to have an FHSA account, you should open one and contribute.

Step 2: Examine the tax attributes

Before deciding how to pay yourself, take the following factors into account:

a) Childcare expenses: If you’re the lower-income spouse/parent and have childcare expenses, these amounts can be deducted against salary but not against dividends. As such, it could make sense to pay salary to benefit from these deductions. Keep in mind only certain childcare expenses can be deducted and there is a limit.

b) Moving Expenses: Certain moving expense are deductible (i.e. if for a relocation for work/business). However, you can only deduct the moving expenses against salary. As such, you should consider paying yourself salary to take advantage of the moving expense deduction.

c) Income Splitting Opportunities: Assess whether you can pay dividends to family members without triggering the Tax on Split Income (TOSI). Income splitting can reduce the overall family tax burden but must be done carefully to avoid penalties. As such, if TOSI doesn’t apply, it may tilt the scale to paying dividends to lower income family members than paying salary.

d) Corporate Balances: Identify your corporation’s balances for:

- Shareholder Loans: Any loans owed to you should be repaid tax-free. This will show up on the liabilities section of the corporation’s balance sheet.

- Paid-Up Capital (PUC): Amounts contributed to your corporation can be withdrawn tax-free.

- Capital Dividend Account (CDA): Allows for tax-free dividends if you make the appropriate election.

- Eligible Refundable Dividend Tax on Hand (ERDTOH): Enables paying eligible dividends (which are lower taxed dividends) from the corporation to recover corporate taxes.

- Non-eligible Refundable Dividend Tax on Hand (NERDTOH): Reflects taxes paid that can be refunded when dividends are paid from the corporation.

- General Rate Income Pool (GRIP): Supports paying eligible dividends at a which are taxed at a lower tax rate.

e) Business Income: Estimate how much income your corporation will generate in the upcoming year. This determines available cash flow and potential tax implications.

f) Small Business Deduction (SBD) Limit: Determine your corporation’s SBD limit. Staying within this limit allows you to benefit from lower tax rates. The SBD limit is that amount of corporate income that you can pay at lower taxes on. It is generally at $500k but various things can reduce it.

Step 3: Pay Out Funds Even If You Don’t Need Them

You should go through this analysis to see if you should pay yourself funds. Even if you don’t immediately need it. Follow these steps in this order to do that:

a) Repay Shareholder Loan: If your corporation owes you money through a shareholder loan, start by repaying it. Repayments are not taxable to you. As such, it is relatively straightforward idea to repay this. Don’t confuse money that your corporation owes you (shown on the liabilities section of a corporation’s balance sheet) with money that you owe your corporation (shown on the assets section of a corporation’s balance sheet).

b) Pay Out PUC: If your shares have PUC or ‘Paid-Up Capital’, it can be paid to you tax-free. This helps extract equity without incurring personal tax liability. You may need to file a legal resolution (not a tax filing) in order to do this.

c) Pay a capital dividend if you have CDA: Pay a capital dividend from your Capital Dividend Account. Don’t forget to file the necessary election. These dividends are tax-free and optimize cash flow. Note that accountants generally charge a fee to make this election so the cost of the election should be compared across the amount of CDA that you plan to pay.

d) Pay Eligible dividends If Your Corporation Has ERDTOH: If your corporation has Eligible Refundable Dividend Tax on Hand, pay eligible dividends. This allows you to recover corporate taxes already paid. Generally, the personal tax will be less than or the same as the corporate tax that will be recovered. If TOSI does not apply, you may want to pay this to a lower income family member before paying yourself.

e) Pay Salary if You Have Childcare Expenses and/or Moving Expenses: Childcare expenses are deductible if you are the lower income parent and moving expenses are also deductible. So if you have either of the two, you should consider paying salary in order to deduct childcare expenses and/pr moving expenses.

f) Pay Non-Eligible Dividends If Your Corporation Has NERDTOH: If your marginal tax rate on non-eligible dividends is 38% or less, distribute non-eligible dividends until your marginal tax rate on non-eligible dividends is more than 38% (approximately when personal income exceeds $175k in Ontario). This is beneficial because personal tax will be less than or the same as the corporation tax that will be recovered from paying non-eligible dividends if you have NERDTOH. If TOSI does not apply, you may want to pay this to a lower income family member before paying yourself. Also, you shouldn’t solely look at your personal income tax, you should look at additional factors like clawback of benefits (i.e. OAS or CCB).

g) Pay Eligible Dividends if Your Corporation has GRIP AND There Will Be No Additional Personal Income: Depending on your existing personal income, you may be able to pay yourself an eligible dividend without nay additional personal income tax. If you have GRIP, you should pay yourself an eligible dividend until there is just enough income to not trigger an personal taxes. If TOSI does not apply, you may want to pay this to a lower income family member before paying yourself. Also, you shouldn’t solely look at your personal income tax, you should look at additional factors like clawback of benefits (i.e. OAS or CCB).

h) Pay Additional Salary If Combined Tax Will Not Change: If paying additional salary doesn’t increase your combined corporate and personal taxes, consider doing so. Using RRSP Contribution Room: If you have RRSP contribution room, you can contribute to your RRSP can get a deduction. It is generally preferable to invest in a corporation than in an RRSP so if you have $100k in your corporation and $100k of room in your RRSP, you can directly pay that to yourself and contribute it to your RRSP without any additional personal income tax.

i) Pay Non-Eligible Dividends To Family Members If There Will Be No Additional Personal Tax: If TOSI does not apply, you may be able to pay dividends to family members without any additional personal income tax to them, depending on their existing personal income. Also, you shouldn’t solely look at their personal income tax, you should also look at additional factors like clawback of their benefits (i.e. OAS or CCB).

Step 4: Pay Out Funds Only If Needed

If funds are still required after completing the above steps, evaluate the following options. Only move on to the next option if you still need funds:

a) Non-Eligible Dividends if There Is Still NERDTOH: If your corporation still has NERDTOH, pay non-eligible dividends. This ensures corporate taxes are refunded while providing cash flow. If TOSI does not apply, you may want to pay this to a lower income family member before paying yourself.

b) Sell investments and use proceeds if you have personal non-registered investments: If you have personal non-registered investments (i.e. investments not in a TFSA, RRSP, or RESP), you can sell those investments and use the proceeds to fund your personal spending. The highest amount of tax you will pay on those sale of those investments is roughly 27% which is significantly less than the tax you would pay in the following options.

c) Eligible Dividends If There Is GRIP:

- If your corporation’s taxable income is below the SBD limit, pay eligible dividends. This takes advantage of lower tax rates on eligible income.

- If your corporation’s taxable income exceeds the SBD limit, pay salary.

d) Pay Salary: Paying salary can help creates RRSP contribution room which is extremely valuable and is deductible to the corporation. However, in unique situations—such as when RRSP room is maximized or EHT applies to the salary—dividends may be preferable. Salaries also contribute to CPP, which provides retirement benefits, though it comes with additional costs to the corporation.

Final Thoughts

Determining whether to pay yourself through salary, dividends, or a combination of both requires a detailed analysis of your financial and tax situation. This guide provides a structured framework, but consulting with a tax professional can help you tailor these strategies to your unique circumstances.

By optimizing how you pay yourself, you can strike the right balance between personal financial goals and corporate tax efficiency.

Contact CoPilot Tax to Optimize Your Compensation Strategy

Deciding between salary and dividends can be complicated, but you don’t have to navigate it alone. At CoPilot Tax, we specialize in creating tailored compensation strategies for business owners to help you minimize taxes and maximize long-term savings.

Get in touch with us today to book a free consultation and learn how to optimize your salary vs dividends strategy!